The Latest Real Estate News

by Anna Lanuza

Westlake Village Housing Market Trends

Westlake Village, CA 91361 - Luxury Real Estate Anna Lanuza Compass 310.295.8807

REPORT FOR 2/21/2024 - Single-Family Homes

This week the median list price for Westlake Village, CA 91361 is $2,995,000 with the market action index hovering around 38. This is less than last month's market action index of 39. Inventory has held steady at or around 50.

Market Action Index

This answers “How’s the Market?” by comparing rate of sales versus inventory.

Slight Seller's Advantage - The market has not shown strong directional trends in terms of supply and demand. However, inventory is sufficiently low to keep us in the Seller’s Market zone and prices have been moving upward as evidence.

Westlake Village, CA 91361

Median List Price - In this zip code this week saw relatively little price change from last week. However, we continue to demonstrate a nice up trend in general over the last several weeks.

Price Per Square Foot - The market appears to be placing an increasing premium on homes. When list prices and price per square foot consistently increase in tandem, as they're doing now, you can often find short-term investment opportunities.

Westlake Village Inventory - Inventory has been falling in recent weeks. Note that declining inventory alone does not signal a strengthening market. Look to the Market Action Index and Days on Market trends to gauge whether buyer interest is changing with the available supply.

Market Action Segments - Not surprisingly, all segments in this zip code are showing high levels of demand. Watch the quartiles for changes before the whole market changes. Often one end of the market (e.g. the high-end) will weaken before the rest of the market and signal a slowdown for the whole group.

Median Days on Market (DOM) - The properties have been on the market for an average of 128 days. Half of the listings have come newly on the market in the past 68 or so days. Watch the 90-day DOM trend for signals of a changing market. It’s worth mentioning that tt is not uncommon for the higher priced homes in an area to take longer to sell than those in the lower quartiles.

Contact me today to learn more about how I can help you achieve your real estate goals. Remember, who you work with matters now more than ever. Call Anna Lanuza today at (310) 295-8807 to schedule a consultation. Let’s work together! Call/text 310.295.8807

Anna Lanuza | 310.295.8807 | DRE 02036269 | Email

#WestlakeVillage #LocalExpert #WestlakeVillageIsland #homes #localagent #AnnaLanuza #Compass #AnnaLanuzaHomes

Calabasas Housing Market Trends

Single Family Homes & Condos | Q3 2023 - San Fernando Valley

MED. SALES PRICE $1.65M - 3% more than in Q3 2022

AVG. DAYS ON MARKET 23 - 4% fewer than in Q3 2022

CLOSED SALES 41 - 29% fewer than in Q3 2022

INVENTORY 39 - 30% fewer than in Q3 2022

Let’s take a look at the Calabasas housing market

Happy New Year! Did you know that the Calabasas home prices were up 14% compared to last year? Homes sold for a median price of $1.6M with an average of 42 days on the market compared to 48 days from last year. The Calabasas housing market is still strong and does not appear to be slowing down anytime soon. If you are still on the fence about buying, I suggest you unpause your search and begin writing offers. While many first time buyers have pulled the plug on owning a home, investors are using this time to negotiate prices and terms.

Homes for sale in Calabasas Village

There are 14 homes for sale in Calabasas Village, one of which was newly listed within a few days week. Calabasas Village is a very desirable community, perched on scenic Mulholland Highway, just minutes from world-famous Malibu beaches. This luxurious community offers the ideal blend of privacy and convenience, you'll enjoy living here. Gorgeous views of the Santa Monica Mountains and minutes away from the best surfing you can imagine. This community is located in the award winning Las Virgenes Unified School District. Nearby luxury shopping, restaurants, and entertainment.

Enjoy exclusive access to Calabasas Village's many luxe amenities, such as a heated Olympic-size pool, spa, basketball court, tennis courts, clubhouse, kids' playground, sauna, gym, dog park, poker room, library, event space with entertainer's kitchen, and beautifully maintained grounds. The HOA covers water, trash, sewer, security, cable, and internet. Also? Zero property taxes. Come live the dream of owning a magical rustic retreat in a thriving community just minutes from the very best the area has to offer.

Contact me today to learn more about how I can help you achieve your real estate goals. Remember, who you work with matters now more than ever, contact Anna Lanuza today at (310) 295-8807 to schedule a consultation. Let’s work together! Call/text 310.295.8807

Anna Lanuza | 310.295.8807 | DRE #02036269 | Email

#AgouraHills #OakPark #WestlakeVillage #Calabasas #homes #localagent #AnnaLanuzaHomes

Spring Time: Agoura Hills, Oak Park, & Westlake Village

Spring is a great time to buy or sell a home, especially in the beautiful neighborhoods of Westlake Village, Agoura Hills, and Oak Park. As a local real estate agent, I am passionate about helping people find their dream homes in these stunning areas. In this blog post, we'll explore some of the best neighborhoods in these areas and how I can help you with your real estate needs.

One of the most desirable neighborhoods in Westlake Village is the First Neighborhood. This community is known for its beautiful tree-lined streets, well-maintained homes, and top-rated schools. As your local real estate agent, I can help you find the perfect home in this neighborhood and guide you through the buying or selling process.

Another popular community in Oak Park is Country Meadows Homes. This neighborhood features beautiful homes with spacious yards, great schools, and a welcoming community atmosphere. If you're looking to downsize or sell your home in this area, I can help you navigate the market and get the best possible price for your property.

Morrison Ranch Homes in Agoura Hills is another beautiful community that boasts stunning homes, great schools, and a close-knit community feel. As your local real estate agent, I can help you find the perfect home in this neighborhood and help you get the best possible price for your current property if you're looking to sell.

If you're looking for something truly unique and special, consider Old Agoura Equestrian Homes. This charming community features homes with equestrian facilities, perfect for horse lovers. As your local real estate agent, I can help you navigate this niche market and find the perfect home for you and your horses.

Whether you're looking to buy or sell a home, downsize, or find a larger home, I can help you with all of your real estate needs in these beautiful areas. As a local real estate agent with years of experience, I have a deep understanding of the local market and can help you find the perfect home in the perfect neighborhood.

Contact me today to learn more about how I can help you achieve your real estate goals. Remember, who you work with matters now more than ever, contact Anna Lanuza today at (310) 295-8807 to schedule a consultation. Let’s work together! Call/text 310.295.8807

Anna Lanuza | 310.295.8807 | DRE #02036269 | Email

#AgouraHills #OakPark #WestlakeVillage #Calabasas #homes #localagent #AnnaLanuzaHomes

Sell Your House in Westlake Village: Why Now is the Perfect Time

Local Real Estate Westlake Village, California Anna Lanuza Homes 310–295–8807

If you're a homeowner in Westlake Village, California, you may be wondering whether it's the right time to sell your house. The answer is a resounding "yes"! The local real estate market is red hot, and there's never been a better time to capitalize on your home's value. In this blog post, we'll explore some of the benefits of selling your house in Westlake Village, and why you should consider working with local agent Anna Lanuza Homes to make it happen.

1.The Westlake Village Real Estate Market is Booming

As a homeowner in Westlake Village, you're sitting on a goldmine. The local real estate market is hot right now, with high demand for homes and low inventory driving up prices. According to recent data, the median home value in Westlake Village is $1.4 million, and prices have risen 7.9% over the past year. With such strong market conditions, now is the perfect time to sell your house and capitalize on its value.

2. Work with a Local Agent Who Knows the Market Inside and Out

If you're thinking about selling your house in Westlake Village, you want to work with an agent who knows the local market inside and out. That's where Anna Lanuza Homes comes in. Anna is a top local agent with over 15 years of experience in the Westlake Village real estate market. She knows exactly what it takes to sell a home in this area, from pricing your house competitively to marketing it effectively to the right buyers. By working with Anna, you can rest assured that you'll get the best possible price for your home in today's market.

3. Selling Your House with Anna Lanuza Homes is Hassle-Free

Selling a house can be a stressful and time-consuming process, but it doesn't have to be. When you work with Anna Lanuza Homes, you'll benefit from a hassle-free selling experience. Anna takes care of everything from start to finish, from marketing your house to negotiating with buyers to closing the deal. She'll work closely with you every step of the way to ensure that you get the best possible outcome from your sale. And because Anna is a local agent who truly cares about her clients, you can count on her to be available whenever you need her.

Ready to Sell Your House in Westlake Village? Contact Your Local Expert Anna Lanuza Today!

If you're ready to sell your house in Westlake Village and capitalize on today's red-hot real estate market, Anna Lanuza Homes is here to help. With her local expertise, industry knowledge, and commitment to her clients, Anna is the perfect partner to help you navigate the selling process and get the best possible outcome for your sale. So why wait? Who you work with matters now more than ever, contact Anna Lanuza today at (310) 295-8807 to schedule a consultation and take the first step towards selling your house in Westlake Village, California.

Let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

#WestlakeVillage #localexpert #localagent #AnnaLanuzaHomes

The Top Benefits of Selling Your House: Why It's a Great Time to Work with a Local Real Estate Agent

Local Real Estate Agoura Hills, Calabasas, Westlake Village, California Anna Lanuza 310–295–8807

If you're a homeowner, you may be considering whether or not to sell your house. Whether you're looking to downsize or move to a new location, selling your house can come with a range of benefits. In this blog post, we'll explore some of the top benefits of selling your house and why it's a great time to work with a local real estate agent.

1. Financial Benefits of Selling Your House

One of the primary benefits of selling your house is the potential for a profit. If you've owned your house for a number of years, you may be able to sell it for more than you originally paid for it, thanks to the rising real estate market. This can provide you with a significant financial boost that can be used to pay off debt, invest in a new property, or save for retirement. Additionally, selling your house can help you reduce your expenses, such as mortgage payments, property taxes, and maintenance costs.

2. Lifestyle Benefits of Selling Your House

Another benefit of selling your house is the ability to change your lifestyle. If you're looking to downsize, for example, selling your house can allow you to move into a smaller, more manageable property that requires less upkeep and maintenance. This can free up more time and energy to pursue hobbies, travel, or spend time with family and friends. Similarly, if you're looking to move to a new location, selling your house can open up new opportunities for career growth, education, and social connections.

3. Emotional Benefits of Selling Your House

Selling your house can also come with a range of emotional benefits. For many homeowners, their house holds a lot of sentimental value, which can make it difficult to let go. However, selling your house can provide a fresh start and a new chapter in your life. Whether you're looking to move closer to family, downsize to a more manageable property, or explore new opportunities in a different location, selling your house can provide a sense of liberation and freedom.

4. Why You Should Work with a Local Real Estate Agent

If you're considering selling your house, it's important to work with a local real estate agent who knows the market and can help you get the best possible price for your property. A local real estate agent can provide you with a range of services, from marketing your property to potential buyers, to negotiating the sale price and handling all the legal paperwork. Additionally, a local real estate agent can provide you with valuable insights into the local real estate market, including trends, competition, and pricing strategies.

Selling your house can come with a range of benefits, from financial gains to emotional liberation. By working with your local real estate agent Anna Lanuza (310) 295-8807, you can ensure that you get the best possible price for your property and make the most of this exciting opportunity to start a new chapter in your life. If you're considering selling your house, now is a great time to do it, so don't hesitate to reach out to Anna Lanuza Homes to get started!

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

#housing #firsttimehomebuyer #localexpert #larealtor #AnnaLanuzaHomes #housingmarket

What You Should Avoid When Applying For a Mortgage

While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may not realize you need to avoid after applying for your home loan.

Don’t Deposit Large Sums of Cash

Lenders need to source your money, and cash isn’t easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

Don’t Make Any Large Purchases

It’s not just home-related purchases that could disqualify you from your loan. Any large purchases can be red flags for lenders. People with new debt have higher debt-to-income ratios (how much debt you have compared to your monthly income). Since higher ratios make for riskier loans, borrowers may no longer qualify for their mortgage. Resist the temptation to make any large purchases, even for furniture or appliances.

Don’t Cosign Loans for Anyone

When you cosign for a loan, you’re making yourself accountable for that loan’s success and repayment. With that obligation comes higher debt-to-income ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

Don’t Switch Bank Accounts

Lenders need to source and track your assets. That task is much easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

Don’t Apply for New Credit

It doesn’t matter whether it’s a new credit card or a new car, when you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), it will have an impact on your FICO® score. Lower credit scores can determine your interest rate and possibly even your eligibility for approval.

Don’t Close Any Accounts

Many buyers believe having less available credit makes them less risky and more likely to be approved. This isn’t true. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those aspects of your score.

Do Discuss Changes with Your Lender

Be upfront about any changes that occur or you’re expecting to occur when talking with your lender. Blips in income, assets or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. Ultimately, it’s best to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

You want your home purchase to go as smoothly as possible. Remember, before you make any large purchases, move your money around, or make major life changes, be sure to consult your lender — someone who’s qualified to explain how your financial decisions may impact your home loan.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

#housing #firsttimehomebuyer #localexpert #larealtor #AnnaLanuzaHomes #housingmarket

The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view homeownership as a key life achievement. Let’s explore just a few of the reasons why so many Americans continue to value homeownership.

The Financial Benefits of Owning a Home

One possible reason homeownership is viewed so highly is because owning a home is a significant wealth-building tool, and it provides meaningful financial stability over renting by locking in your monthly housing payments for the length of your home loan. An article from Forbes explains:

“Understanding the potential benefits of homeownership helps individuals see the value of owning property instead of renting. . . . household wealth among homeowners is a whopping 1,469% higher on average compared to renters, excluding home equity, making the allure of homeownership even more enticing.”

Over time, owning a home not only helps boost your own net worth, but it also sets future generations up for success as you pass that wealth down. That may be why the Mynd report also says:

“Most Americans (78%) still associate homeownership with the ‘American dream.’ And nearly two-thirds of Americans (65%) see homeownership as a means of building intergenerational wealth.”

The Non-Financial Benefits of Homeownership

While the financial benefits of owning a home are important, becoming a homeowner impacts you on a social and emotional level, too. As Mark Fleming, Chief Economist for First American, says:

“. . . buying a home is not just a financial decision. It’s also a lifestyle decision.”

Your home provides feelings of achievement, responsibility, and more. 3by30 highlights the top 10 benefits homeowners enjoy. A few non-financial advantages include:

Providing you with more freedom and control over your living space

Giving you a greater sense of pride

Helps with community engagement

What Does That Mean for You?

If your definition of the American Dream involves greater freedom and prosperity, then homeownership could play a major role in helping you achieve that dream. While it may feel challenging to buy a home today as mortgage rates and home prices rise, if the time is right for you, know that there are incredible benefits waiting for you at the end of your journey. You’ll have a place you can grow your wealth, call your own, and feel most comfortable.

Like the National Association of Realtors (NAR) says:

“. . . research has consistently shown that homeownership is also associated with multiple economic and social benefits to individual homeowners. Homeownership has always been an important way to build wealth.”

Bottom Line

Buying a home is a powerful decision and a key part of the long-term dream for many Americans. And if homeownership is part of your dreams this year, let’s connect to start the process today.

Are you interested in talking more about buying or selling an investment property? Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Remember, who you work with matters now more than ever before.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

#housing #firsttimehomebuyer #localexpert #larealtor #AnnaLanuzaHomes #housingmarket

First-Time Homebuyers Make Up Nearly Half The Market

First-time homebuyers call Anna Lanuza Homes 310-295-8807

First-time homebuyers represent 45% of the market, up from 37% last year.

KEY TAKEAWAYS

Declining home values and a cooling housing market are two key factors giving first-time buyers an edge.

First-time homebuyers have returned to the housing market, and those who can afford a home are finding success. In fact, the share of buyers purchasing a home for the first time has rebounded to pre-pandemic levels, now representing 45% of all buyers.

That’s up from 37% of buyers surveyed last year, according to 2022 Consumer Housing Trends Report. This may be attributed directly to declining home values and a cooling market, allowing new buyers to survey their housing options.

The share of first-time buyers plummeted during the pandemic, as first-time shoppers lost out to older, repeat buyers who were able to tap the equity in their existing homes and use cash to make a stronger offer.

A survey done in June found younger buyers were more likely to report losing to an all-cash buyer at least once, as was the case for 45% of Gen Z and 38% of millennial buyers, compared to 30% of all buyers.

"First-time buyers now appear to be making relative gains as high mortgage interest rates disproportionately encourage current homeowners to stay put," said Manny Garcia, a population scientist. "The flow of homes into the market is slowing, suggesting homeowners are likely comparing their current low mortgage rate to today's rates and deciding not to move. While rising mortgage rates are hurting affordability for all buyers, first-time buyers may be less deterred by higher rates because they're comparing a monthly mortgage payment to what they're paying in rent."

Recent research from August found that those affordability challenges have driven up demand for the lowest-priced homes in each market. While there are fewer buyers overall, first-time buyers may find more competition for starter homes.

Not all hope for first-time homebuyers is lost. Today’s market rebalancing has the potential to especially benefit these buyers and grant them the flexibility to shop without trying to time the purchase of their new home with the sale of an existing home. Real Estate Experts noted that listings typically lingered 16 days on the market in August before going under contract, compared to eight days in June, meaning buyers have twice as much time to decide on a home compared to this time last year.

As new buyers begin to enter the market, please read the five tips to aid homebuyers:

Understand what is affordable and use a mortgage calculator.

Finance first and aim for a preapproval.

Connect with an experienced agent.

Take advantage of real estate technology.

Keep the contingencies.

Are you interested in talking more about buying or selling an investment property? Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Remember, who you work with matters now more than ever before.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

#housing #firsttimehomebuyer #localexpert #larealtor #AnnaLanuzaHomes #housingmarket

5 Tips for LIVING IN A FOR-SALE HOME

Of all the noteworthy things involved with selling a home, one thing people don’t talk about is how uncomfortable is to be living in a for-sale property. Your home doesn’t really feel like your own during this period, and it’s only natural that things will seem a little off. Living in a for-sale home means frequently have to leave at the last minute for showings, open houses, as well as having to keep your place in tip top shape at all times. There are a few things to make the process more comfortable and while keeping you from losing your sanity. Read the tips below for the survival advice you’ll need to get through it.

1. Declutter, Trash, and Donate

Spend some time looking through your belongings and get rid of everything you no longer want or need. Less is always more when it comes to both optimizing your home for a quick sale and moving, so edit down your items and don’t hold on to anything that isn’t serving some sort of purpose in your life. While your house is listed for sale, you’ll want to optimize its space, and that means getting rid of the junk you don’t need. Go through your closet, attic, or any place in your house you may have let old clothes pile up, and organize them into garbage bags. Once you’ve done this, find your nearest donation site and give your old clothes, furniture, household items away. Not only are you helping someone else in need, but you are decluttering your home and increasing the chances of it selling.

2. Keep your home clean

A messy, dirty, or cluttered home is a big turn off for buyers, but constant cleaning can be a headache for sellers. Make it as simple as possible by taking small steps to keep your home at the level of cleanliness it needs to be at to show its best. That means always cleaning dishes right after you use them, making beds in the morning, vacuuming and dusting at least every other day, and just generally keeping clutter to a minimum. Get the whole family involved with a chore chart and assign cleaning tasks based on age and skill level. And whatever you do, don’t fall behind when it comes to your home’s cleanliness lest you end up running around cleaning like a madman when a buyer schedules a showing.

3. Have a plan in place for the fur babies

With the influx of prospective buyers that will be touring your home, you need to make sure your pets’ toys are cleaned up and out of sight. Get rid of any waste that might be in the yard and crack open a window to let in some fresh air if you need to eliminate that pet smell from your house. Remember, pets odors can become familiar to us and may be much more noticeable to prospective buyers touring your home.

4. Secure valuables

Showings and open houses are common activities while a home is listed for sale, many prospective buyers will be visiting the property on a weekly basis. While agents are vigilant, you can facilitate the process by making sure all valuables are hidden away in a safe and secure location. Please note, this is not limited to just jewelry, money, and prized possessions, but also relevant to any important documentation and medications. You will feel a lot better about leaving your house knowing your important belongings are stashed away securely.

5. Have a set Schedule for showings and open houses

The goal is to do everything possible for buyers to have access to your home, which include showings and open houses. Have an idea of what times you can’t be in your home so you can plan something productive to do in the meantime. Having an activity will make the time go faster and ease the stress of having to vacate your house. Moving into a new home is an oft-discussed stressful time, but not enough attention is paid to the stress of living in a home that’s listed for sale. Living in a house on the market can be inconvenient and anxiety-inducing. Use these tips to take some control back and provide some structure at a very chaotic point in the home-selling process!

Are you interested in talking more about buying or selling an investment property? Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Remember, who you work with matters now more than ever before.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

Crossroads Kitchen Almost ready to OpeN at The Commons in Calabasas

Exciting news! Vegan eatery Crossroads Kitchen at The Commons at Calabasas is working hard to open soon... no promises but I've heard it could be as soon as in a couple weeks. The signs are up and they are currently hiring. You'll find things like Philly Cheesesteak, Sicilian Supreme Pizza and Italian Sausage Sandwich on their menu, none of which contain animal products.

Learn more at crossroadskitchen.com.

CROSSROADS KITCHEN

Their KITCHEN IS YOURS At Crossroads, they are dedicated to sharing their passion for plant-based cuisine through uncompromising quality, culinary innovation and sincere hospitality with their clients and guests. They believe in creating all menus based on collaborations with you. Send a request and they’ll create something unique just for your special event.

In addition to catering, they also host private events in their restaurant. They have two private rooms; The Private Dining Room (PDR) which can seat up to 20 and The Wine & Cheese Room which can seat up to 40. They are also available for full buyouts of the restaurant.

Please fill out the form below and they will provide more information. Crossroads offers a full array of catering services with customized menus that will have something for everyone.

For cake request email them directly at: cakes@crossroadskitchen.com

Are you interested in talking more about buying or selling an investment property in Calabasas? Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Remember, who you work with matters now more than ever before.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

Are you reaping the full benefits of your rental property?

Investment Property Search Anna Lanuza 310.295.8807

Whether you currently own a rental property or are considering making the leap, here are some tax write-offs to be aware of that may be deducted from your rental income:

• Mortgage interest — if you carry a mortgage on your rental, you are eligible to deduct the interest from your rental income;

• Ordinary and necessary expenses — costs paid to maintain and manage your property may be deducted, including maintenance, repairs, insurance and advertising;

• Depreciation — renovations to improve the property beyond its original condition aren’t deductible, but they may be offset through depreciation, which is deductible; and

• Property taxes — just like with your principal residence, you may be able to deduct limited property tax payments.

When you sell your rental property, research §1031 exchanges, which allow you to defer capital gains taxes paid upon the sale when you purchase a similar replacement property.

Are you interested in talking more about buying or selling an investment property? Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Remember, who you work with matters now more than ever before.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser.

Why Buying a Home May Make More Sense Than Renting

Some Highlights

If you’re trying to decide whether to rent or buy a home, consider the advantages homeownership offers.

Buying a home can help you escape the cycle of rising rents, it’s a powerful wealth-building tool, and it’s typically considered a good hedge against inflation.

If you’re ready to take advantage of the benefits of homeownership, let’s connect to explore your options.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

Thinking of Selling Your House This Fall?

Let’s work together!

Today’s market is at a turning point, making it more essential than ever to work with a real estate professional. Not only will a trusted real estate advisor keep you updated and help you make the best decisions based on current market trends, but they’re also experts in managing the many aspects of selling your house.

Here are five key reasons why working with a real estate professional makes sense today.

1. A Professional Follows the Latest Market Trends

With higher mortgage rates and moderating buyer demand, conditions are changing and staying on top of the latest market information is crucial when you sell.

Working with an expert real estate advisor helps ensure you can stay updated on what’s happening. They know your local area and follow national trends too. More importantly, they’ll know what this data means for you, and as the market shifts, they’ll be able to help you navigate it and make your best decision.

2. A Professional Helps Maximize Your Pool of Buyers

Your agent’s role in bringing in buyers is important. Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS) to ensure your house is viewed by the most buyers. Investopedia explains why it’s risky to sell on your own without the network an agent provides:

“You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home. A smaller pool of potential buyers means less demand for your property, which can translate into waiting longer to sell your home and possibly not getting as much money as your house is worth.”

3. A Professional Understands the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) explains it best, saying:

“Selling a home typically requires a variety of forms, reports, disclosures, and other legal and financial documents. . . . Also, there’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.”

A real estate professional knows exactly what needs to happen, what all the fine print means, and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own.

4. A Professional Is a Trained Negotiator

If you sell without a professional, you’ll also be solely responsible for all the negotiations. That means you’ll have to coordinate with:

The buyer, who wants the best deal possible

The buyer’s agent, who will use their expertise to advocate for the buyer

The inspection company, which works for the buyer and will almost always find concerns with the house

The appraiser, who assesses the property’s value to protect the lender

In today’s changing market, buyers are regaining some negotiation power as bidding wars ease. Instead of going toe-to-toe with all the above parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

5. A Professional Knows How To Set the Right Price for Your House

If you sell your house on your own, you may be more likely to overshoot your asking price. That could mean your house will sit on the market because you priced it too high for where the market is now. Today, pricing a house requires even more expertise to ensure you get it right. NAR explains it like this:

“A great real estate agent will look at your home with an unbiased eye, providing you with the information you need to enhance marketability and maximize price.”

Real estate professionals know the ins and outs of how to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your home. These steps are key to making sure it’s set to move quickly while still getting you the highest possible final sale price.

Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you’ll want to rely on throughout the transaction. Remember, who you work with matters now more than ever before.

Call me, let’s work together! Call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

Agoura Hills Housing Market

Home Search in Agoura Hills Anna Lanuza 310.295.8807

In August 2022, Agoura Hills home prices were up 21.3% compared to last year, selling for a median price of $1.5M. On average, homes in Agoura Hills sell after 43 days on the market compared to 30 days last year. There were 28 homes sold in August this year, down from 29 last year. Agoura Hills is somewhat competitive. Hot homes receive multiple offers.

The average homes sell for around list price and go pending in around 40 days.

Hot homes can sell for about 4% above list price and go pending in around 27 days.

Which homebuyers are searching to move into Agoura Hills?

Across the nation, 6% of homebuyers searched to move into Agoura Hills from outside metros. San Jose homebuyers searched to move into Agoura Hills more than any other metro followed by San Diego and Seattle.

Where are Agoura Hills home buyers searching to move to?

80% of Agoura Hills homebuyers searched to stay within the Agoura Hills metropolitan area. San Diego was the most popular destination among Agoura Hills homebuyers followed by Las Vegas and Phoenix.

Anna Lanuza | c. 310.295.8807 | DRE02036269 | www.annalanuza.com

#AgouraHills #AgouraHillsHomes #Homeforsale #AgouraHillsRealestate #AgouraRealtor #AnnaLanuzaHomes #larealtor #laliving #familyhome #homebuyer

Why You Should Consider Condos

as Part of Your Home Search

The historically low inventory over the past few years led to challenges for many buyers trying to find a home that met their needs and their budget. If you’re in the same boat, you should know the recent shift in the housing market may have opened up doors for you to restart your search.

The inventory of homes for sale has increased this year, and that’s giving buyers much needed options. As Danielle Hale, Chief Economist at realtor.com, says:

“. . . today’s shoppers have more than 5 homes to consider for every 4 they had at this time a year ago.”

But perspective is important. Overall, housing supply is still low. If you need even more choices, expanding your search by adding additional housing types, like condominiums, could help.

Exploring Condos Could Add Options That Fit Your Budget

One thing to consider is condos generally differ from single-family homes in average space and floor plans. But that size difference is one reason why condos can be a more affordable option. According to a recent report from realtor.com, condo buyers paid roughly 7% less for their home than buyers of other housing types last year. With rising mortgage rates and home prices, the relative affordability of a condo could be worth considering.

Remember, your first home doesn’t have to be your forever home. The important thing is to get your foot in the door as a homeowner. Buying a condo now can springboard you into a bigger home later on. An article from the Urban Institute explains:

“Because condos and co-ops are generally more affordable, they tend to help first-time homebuyers step onto the first rung of the homeownership ladder. These buyers often use the equity on their condo to then purchase a larger single-family home.”

In other words, owning a condo will help you start building wealth in the form of home equity. In time, the equity you build can fuel a future purchase should you decide you want to buy a home with more space or different amenities.

Condo Living Provides Several Great Perks

Boosting the number of options in your budget during your home search is just one reason to consider condos, but there are several other benefits to condo living.

First, they tend to require minimal upkeep and lower maintenance – and that can give you more time to spend doing the things you enjoy. A recent article from Bankrate highlights this, saying:

“Condos can be a good option for anyone who wants to keep home maintenance to a minimum . . . if the roof is leaking or the carpet in the lobby needs to be replaced, that’s not your responsibility — the condo association handles those duties.”

Plus, since many condos are located in or near city centers, they offer the added benefit of being in close proximity to work and leisure. Again, realtor.com explains:

“Buying a condo, which is generally less expensive than a single-family home, enables a household to afford to own in the middle of it all, and often means a newer-built home with less maintenance responsibility.”

Ultimately, owning and living in a condo can be a lifestyle choice. And if that appeals to you, they could give you the added options you need to buy your first home.

Adding condominiums to your housing search could be a great move. If you’re ready to search condos in our area, let’s connect today. For additional information call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

TARZANA HOMES - 6211 Nestle Avenue, Tarzana, CA

This turnkey, sophisticated Tarzana home is the perfect blend of elegance and designer finishes. Elegantly situated on one of the most sought-after cul-de-sac streets in the valley, this home is the pinnacle of luxury and impeccable curb appeal. As you walk through this masterfully designed home, the expansive, open concept formal living room and dining area, you will appreciate the gorgeous, soaring ceilings, large windows engulfed in natural lighting, and wood-like flooring throughout. Follow the hardwood floors to the family room that eludes opulence, style, and a traditional fireplace.

The excellent architectural designs throughout, continue with the custom designed gourmet kitchen featuring five slabs of real quartz meticulously crafted to evoke gorgeous, flowing countertops, a matching island/breakfast nook, and a full height backsplash that wraps around to the window. The kitchen is a cook's dream complete with Thermador appliances, sleek cabinetry, and butler's pantry. So many other features including recessed lighting, French doors, wood flooring throughout, NEST thermostat, top of the line Rheem 5 Ton complete HVAC air scrubber plus air purifier system, Rheem series two stage gas furnace, and many more. Other amenities include a powder room, a separate laundry room equipped with a full size washer and dryer, sink area, and additional storage space.

Listed for $1,188,000

4 Bedrooms | 3 Bathrooms | 3 Car Garage

For additional information call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

Simi Valley Homes - 6180 Wisteria Simi Valley, CA 93063

Turnkey ready, this Simi Valley home will surprise and delight at every opportunity for these seeking a sophisticated lifestyle! Premium finishes include new exterior and interior paint, quartz counters, new stainless steel kitchen appliances, updated electrical, new roof, new washer and dryer, new HVAC system, bamboo flooring throughout, updated electrical, recess lighting throughout, new heat repellent insulation, fiberglass attic insulation, and so many more to list!

Listed for $688,000

3 Bedrooms | 2 Bathrooms | 2 Car Garage

Lot 5,663 Sq. Ft. | Gated RV Parking

For additional information call/text 310.295.8807 or email AnnaLanuzaRealty@Gmail.com

For more videos please visit https://youtu.be/IvNVjtsPrj8

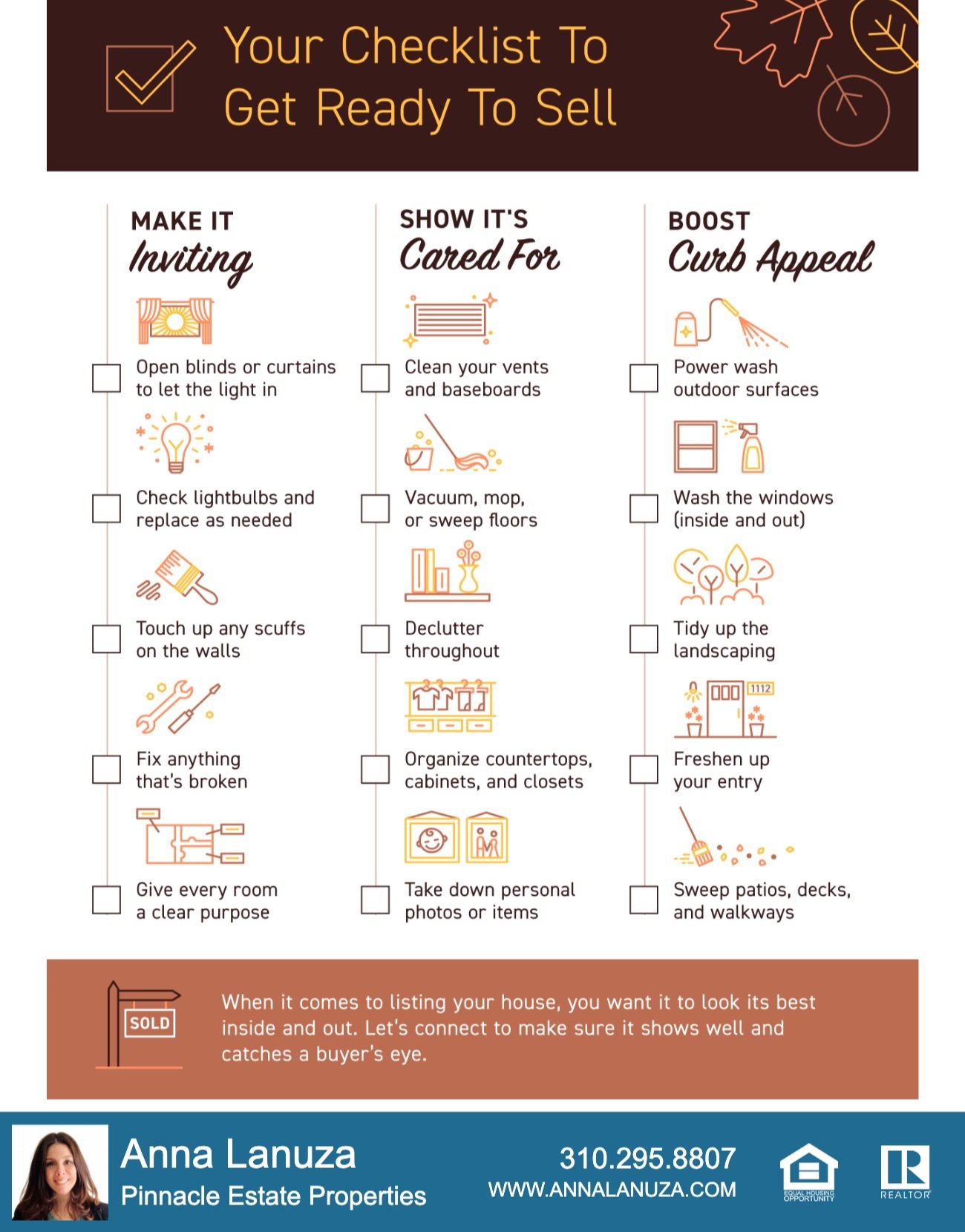

Getting Your House Ready To Sell?

Work with an Agent for Expert Advice

What You Need To Know About Your Local Market

In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – do before selling your house.

Here are some considerations a professional will guide you through.Since the supply of homes for sale has increased so much this year, today’s buyers have more options than they had last year. That may mean you’re not able to ignore some of those repairs or cosmetic updates you could have skipped in previous months. As a recent article from realtor.com says:

“To stand out in the market, sellers should make their home attractive to buyers, which usually means some selective updates.”

The key word here is selective. Since it’s still a sellers’ market, focusing on a few key areas may be enough to make your house stand out from other options. And since inventory is still low overall, it’s also possible buyers may be willing to handle the renovations themselves once they move in. It all depends on buyer demand and the available inventory in your local area. For advice on what’s happening in your market and what to do to make your house show well, lean on a professional.

Not All Renovation Projects Are Equal

In addition to making sure your house makes a good first impression, you’ll also want to consider the return on your investment (ROI) for any renovations. According to the 2022 Remodeling Impact Report from the National Association of Realtors (NAR), here are the projects that could net you the best return when you sell your house (see visual below):

Again, your real estate advisor is your best resource. When your agent comes to your house for a walk-thru and consultation, they’ll use their expertise to offer any insight into what you may need to repair, replace, or refinish. They also know what other sellers are doing before listing their homes and how buyers are reacting to those upgrades to help steer you in the right direction. As Dr. Jessica Lautz, Vice President of Demographics and Behavioral Insights for NAR, explains:

“This year, the winner was hardwood flooring. Hardwood floor refinishing and putting in new wood flooring had the most significant value, . . .”

How To Draw Buyer Attention to the Upgrades You’ve Made

For any projects you’ve already completed or for those you plan to do before listing, make sure your real estate professional knows. They’re not just an advisor to help you decide where to focus your efforts, they’re also skilled at highlighting any upgrades in your listing. That way, potential buyers know about the features that may help sell them on the house.

No matter what, contact a local real estate professional for expert advice on what work needs to be done and how to make it as appealing as possible to future buyers. Every home is different, so a conversation with your agent is mission-critical to make sure you make the right moves when selling this season.

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Remember, who you work with matters now more than ever before. Call me! Please EMAIL for all media inquiries.

#AgouraHills #OldAgoura #designtrends #AnnaLanuzaHomes

Beautiful under-the-radar design trends will have their moment in 2023

From colors to materials to textures, these six design trends were all spotted in Milan and will set the style agenda around the world

This year’s Salone del Mobile in Milan ushered in the design trends we’ll all be seeing a lot of next year. It's where the most innovative and high end brands get together to show their new work to buyers and press from around the world, and where new ideas are born that slowly filter out into the wider world.

I always think of Milan as a place where the 'cerulean choosers' gather. Do you remember that scene in Devil Wears Prada where Miranda Priestley witheringly explains the reason behind Andy's blue jumper? That Oscar de la Renta used it in his catwalk show first, then another designer did, and gradually the high street picked up on it?

Well, Salone does the same for decor. With so many of the world's most brilliant minds creating the pieces on display, and so many of the world's keenest eyes trained on what's happening, it's inevitable that themes which start here will crop up elsewhere.

So from luxe to convivial to a dash of decorative spice, here are the interior design trends that may be under the radar now, but that are how I think you’ll be decorating in 2023 and beyond.

SOCIAL SEATING

Image credit: Arflex

As one of the team at Calligaris stated, ‘the world has changed and so must what we design.’ This seismic shift has resulted in a fleet of seats that aim to aid relationships and connection, a realisation that these are what ought to be the priority in life.

At Edra, designer Franceso Binfare interpreted this with the Standalto sofa, with its pillow-like cushions you can bend to be as upright or flat as you liked depending on how you wish to repose as you share the seat with friends, while both Bonaldo’s Sleek chair and Arflex’s Delta Vienna lounge chair (seen from behind, above) are angled so that you can’t help but look up and into the eyes of the people around you. Adding the plump, welcoming roundness of the Arflex’s Marenco sofa (above) completes the set for this most beguiling of living room trends.

And Nardi has taken this feeling outside - the Net Lounge chair in red, turquoise or black made for creating little groups in which to recline and relax together.

Paprika

Design by Scavolini

Isn’t warmth a mood we all want from our homes? Step forward paprika, the punchier cousin of terracotta that adds a dash of heat. Used across outdoor tables at Flexform, dressers at Galotti & Radice and sofas at Calligaris, it’s the new neutral that goes with anything.

Yes, even when it comes to bathroom trends it has managed to find a way in. Scavolini, above, shows how it brings out the kinder tones in grey, updating a neutral suite. And quite literally spicing up your (home) life.

CURIOSITY CABINETS

Image credit: Cattelan Italia

For a while now, even minimalism has embraced the idea of putting your most treasured pieces out for show, filling your home with personality and making you smile every time.

Perhaps it's only logical that curiosity cabinets are going to have a moment in interior design.

Glass fronted cupboards were being seen at Cattelan Italia, above, Galotti & Radice and Rimadesio, and I think they're the new version of open living room shelving. They give your pieces the gravitas of a museum display.

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Remember, who you work with matters now more than ever before. Call me! EMAIL for all media inquiries.

#AgouraHills #OldAgoura #designtrends #AnnaLanuzaHomes

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

There’s no denying the housing market is undergoing a shift this season as buyer demand slows and the number of homes for sale grows. But that shift actually gives you some unique benefits when you sell. Here’s a look at the key opportunities you have if you list your house this fall.

Opportunity #1: You Have More Options for Your Move

One of the biggest stories today is the growing supply of homes for sale. Housing inventory has been increasing since the start of the year, primarily because higher mortgage rates helped cool off the peak frenzy of buyer demand. But what you may not realize is, that actually could benefit you.

If you’re selling your house to make a move, it means you’ll have more options for your own home search. That gives you an even better chance to find a home that checks all of your boxes. So, if you’ve put off selling because you were worried about being able to find somewhere to go, know your options have improved.

Opportunity #2: The Number of Homes on the Market Is Still Low

Just remember, while data shows the number of homes for sale has increased this year, housing supply is still firmly in sellers’ market territory. To be in a balanced market where there are enough homes available to meet the pace of buyer demand, there would need to be a six months’ supply of homes. According to the latest report from the National Association of Realtors (NAR), in July, there was only a 3.3 months’ supply.

While you’ll have more options for your own home search, inventory is still low, and that means your home will still be in demand if you price it right. That’s why the most recent data from NAR also shows the average home sold in July still saw multiple offers and sold in as little as 14 days.

Opportunity #3: Your Equity Has Grown by Record Amounts

The home price appreciation the market saw over the past few years has likely given your equity (and your net worth) a considerable boost. Danielle Hale, Chief Economist at realtor.com, explains:

“Home owners trying to decide if now is the time to list their home for sale are still in a good position in many markets across the country as a decade of rising home prices gives them a substantial equity cushion . . .”

If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help. It may be just what you need to cover a large portion (if not all) of the down payment on your next home.

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Remember, who you work with matters now more than ever before. Call me! EMAIL for all media inquiries.

#AgouraHills #OldAgoura #Calabasas #SimiValley #AnnaLanuzaHomes

Bring Positive Energy And Good Fortune Into Your Home

It’s not just people who have energy. Plants do too! Thank goodness for that, because as science tells us plants really can make a big difference in your home and life overall – especially feng shui principles of observing how things are placed to enhance or diminish an area’s “energy flow.” A study sponsored by NASA suggests that plants purify the indoor air of toxins like formaldehyde. Here’s a list of ten awesome houseplants you should get for your home, so make sure to check them out!

1. Peace Lily

The Peace Lily is a plant that will bring good vibes into your home. It’s used for purifying and neutralizing harmful gases, so it thrives in dark shade areas like bedrooms or offices. Peace lilies are among the top houseplants used to purify the air. According to the University of Minnesota Extension while all plants absorb carbon dioxide and release oxygen as part of the photosynthesis process, peace lilies also absorb airborne pollutants such as benzene, formaldehyde and trichloroethylene. Peace lilies are effectively remove benzene, a byproduct of inks, oils, paints, plastics, rubber, dyes, detergents, gasoline, pharmaceutical, tobacco smoke and synthetic fibers. In addition peace lilies absorb trichloroethylene, which are generally derived from metal degreasing and dry cleaning industries; also printing inks, paints, lacquers, varnishes and adhesives.

2. Palm

With beautiful lush fronds that bring a tropical look indoors, palm plants look truly amazing with every decor. Removes Carbon Dioxide and Carbon Monoxide Proven in this research, indoor palm varieties like areca palm and bamboo palm can effectively reduce CO2 and carbon monoxide from the air. It has also been found in a study that the areca palm is best in eliminating CO2 from the air and providing oxygen. Bamboo palm (Chamaedorea seifrizii) is also considered a great alternative in cleaning carbon monoxide from the air.

3. Rosemary

Rosemary is not just for culinary purposes – it boasts an array of health benefits! The herb has been proven to improve memory, treat insomnia and lift people’s spirits. The scent of rosemary leaves is great for healing lung congestion as well. Like eucalyptus, rosemary relaxes the lungs and reminds them to open up and breathe. Drop some fresh sprigs of rosemary in a pot of water to simmer, and you’ll infuse the air with the herb’s breathe-easy aroma. Studies have shown that rosemary may even be a helpful recovery tool after you’ve had a stroke. Furthermore, it may have the potential to reduce brain damage and speed healing.

4. Orchid

Many studies have shown that many indoor plants and flowers have natural air-purifying properties that can get rid of harsh toxic substances. Our favorite orchids are actually among the beneficial plants you should definitely have at home or in the office. Dendrobium orchids, in particular, can improve the quality of the air you breathe indoors by stripping airborne xylene and other chemical solvents, which we unknowingly get exposed to from seemingly innocent everyday stuff, such as cleaning agents, painting supplies, or exhausts.

5. Lucky Bamboo

Lucky bamboo is believed to bring and circulate qi within the area it is located. The number of stalks represents positive energies. The familiar three stalk bamboo plant usually represents the bringing of happiness, wealth and longevity. The 21 single stalks or curled stalks represent all around good fortune to all that care for the plant and live in the area. Since the lucky bamboo is believed to bring qi it is considered an ideal plant to place near someone who is sick.

6. Jade

The Jade plant is believed to attract prosperity and fortune in many Asian countries. In Feng Shui, it’s a symbol of good luck and consistency because it’s an evergreen plant. It’s a perfect plant for both your home and office. Known as the “Money Tree,” this plant brings wealth and prosperity to your household. It makes for an awesome house plant because it requires almost no watering!

7. Ficus

The large leaves are what make this plant an ideal choice for office decoration. In addition to the aesthetic appeal, the Ficus Lyrata will bring a range of health benefits. For starters, its broad leaves will help with air purification. Through the process of metabolic breakdown, the office plants will eliminate various chemical compounds from the air. This means fewer ailments especially those related to the respiratory system. In addition to that, the plant will help with humidity control. This is essential in the elimination of dust from the air and preventing such problems as coughs, colds, sore throats and fatigue.

8. African Violet

African Violets are a symbol of wealth and prosperity. They’re also kind enough to keep your house clean with their cute little flowery petals! The aroma of this African violet boasts thick and smooth fuzzy leaves and bright pink blossoms. This plant is recognized for the sweet scent of its flowers which makes it a widely admired plant to have around the home. The aroma of summer African violet thrives in conditions of partial sunlight and is easy to look after as it only requires moderate watering.

9. English Ivy

English ivy scientifically known as Hedera helix also known as European ivy or only ivy, is a native to Europe. This plant is an evergreen climbing ornamental vine and grown in gardens houses and on fences. English ivy helps in reducing indoor air pollution and certain allergens from the house like molds and other fungus growth. Therefore its dual importance of improving the environment along with its beautiful ornamental looks makes this plant one of the most desirable indoor air purifying plants.

10. Citrus trees

Citrus plants are a feng shui addition to the kitchen as fruit-bearing plants symbolize abundance and health. Citrus plants like humid conditions. They will thrive in humid rooms like bathrooms and kitchens. Also, you can raise the humidity of other rooms by running a humidifier or placing the citrus trees on a pebble tray that you supply with water.

Remember, who you work with matters now more than ever before. Call me!

EMAIL for all media inquiries.

#houseplants #benefits #AgouraHills #OldAgoura #Calabasas #AnnaLanuzaHomes

Understanding Probate

Everyone has a will or plan, whether created or by default. Even if you have not made out a will or a trust, you still have a plan – a plan dictated by the laws of the state where you reside upon your death. Making a will is not a way to avoid “probate,” the court procedure that changes the legal ownership of your property after your death. Probate makes sure it is your last valid will, appoints the executor named in your will and supervises the executor’s work. You can do several things now that can help your executor and family later, hopefully much later, on.

I am in possession of a will that distributes the decedent’s estate to me, isn’t this all I need?

No. The will must be admitted to probate and the estate of the decedent must be “probated.”

What does “probate” actually mean?

Generally, probate is a court proceeding that administers the estate of an individual.

What is the purpose of “estate administration”?

Generally, there are five purposes, many of which have subsets to them:

1. To determine that the decedent is in fact dead.

2. To establish the validity of the will.

3. To identify the heirs and devisees of the decedent.

4. To settle any claims that creditors may have against the estate of the decedent.

5. To distribute the property.

Who is the Public Administrator?

Generally speaking, a public administrator is a person or entity appointed by the State to act when there is no will or relatives.

What is the difference between “Testate” and “Intestate?”

When one is said to have died “Testate,” it means he or she died leaving a will. If one is said to have died “Intestate,” it means he or she died without leaving a will.

Remember, who you work with matters now more than ever before. Call me 310.295.8807

For all media inquiries, contact: A.LanuzaRE@Gmail.com

#Probate #ProbateAgent #AgouraHills #Calabasas #Sellers #AnnaLanuzaHomes

The U.S. Homeownership Rate Is Growing

The desire to own a home is still strong today. In fact, according to the Census, the U.S. homeownership rate is on the rise. To illustrate the increase, the graph below shows the homeownership rate over the last year:

That data shows more than half of the U.S. population live in a home they own, and the percentage is growing with time.

If you’re thinking about buying a home this year, here are just a few reasons why so many people see the value of homeownership.

Why Are More People Becoming Homeowners?

There are several benefits to owning your home. A significant one, especially when inflation is high like it is today, is that homeownership can help protect you from rising costs. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“In the 1970s, when inflation was running around 10%, home prices were rising at approximately the same rate. Renters actually have a harder time in inflationary periods, because rents tend to rise along with inflation, whereas mortgage payments stay the same for homeowners with fixed-rate mortgages.”

When you buy a home with a fixed-rate mortgage, you can lock in what’s likely your biggest monthly expense – your housing payment – for the duration of that loan, often 15-30 years.

That gives you a predictable monthly housing expense that can benefit you in the short term, but you’ll also gain equity over time as your home appreciates in value and you make your monthly mortgage payment.

And with that growing equity, your net worth will increase as well. In fact, the latest data from NAR shows the median household net worth of a homeowner is roughly $300,000, while the median net worth of renters is only about $8,000. That means a homeowner’s net worth is nearly 40 times that of a renter.

The U.S. homeownership rate is growing. If you’re ready to purchase the home of your dreams, let’s connect so you can begin the homebuying process today.

Remember, who you work with matters now more than ever before. Call me 310.295.8807

For all media inquiries, contact: A.LanuzaRE@Gmail.com

#AgouraHills #Calabasas #Sellers #Buyers #HomeOwnership #AnnaLanuzaHomes

Experts Increase 2022 Home Price Projections

If you’re wondering if home prices are going to come down due to the cooldown in the housing market or a potential recession, here’s what you need to know. Not only are experts forecasting home prices will continue to appreciate nationwide this year, but most of them also actually increased their projections for home price appreciation from their original 2022 forecasts (shown in green in the chart below):

As the chart shows, most sources adjusted up, and now call for more appreciation in 2022 than they originally projected this January. But why are experts so confident the housing market will see ongoing appreciation? It’s because of supply and demand in most markets. As Bankrate says:

“After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.”

Knowing that experts forecast home prices will continue to appreciate in most markets and that they’ve actually increased their original projections for this year should help you answer the question: will home prices fall? According to the latest forecasts, experts are confident prices will continue to appreciate this year, although at a more moderate rate than they did in 2021.

Bottom Line

If you’re worried home prices are going to decline, rest assured many experts raised their forecasts to say they’ll continue to appreciate in most markets this year. If you have questions about what’s happening with home prices in our local area, let’s connect.

Remember, who you work with matters now more than ever before. Call me 310.295.8807

For all media inquiries, contact: A.LanuzaRE@Gmail.com

#Bankrate #AgouraHills #Calabasas #Sellers #Buyers #Homes #AnnaLanuzaHomes

Planning To Retire? Your Equity Can Help You Reach Your Goal.

Whether you’ve just retired or you’re thinking about retirement, you may be considering your options and trying to picture a whole new stage of your life. And you’re not alone. Research from the Retirement Industry Trust Association (RITA) shows 10,000 Baby Boomers reach the typical retirement age (65) every day, and only 47% of the people in that generation have already retired.

If this sounds like you, one thing worth considering is whether or not your current home will suit your new lifestyle. If your home doesn’t have the features or benefits you’re looking for, the good news is, you may be in a better position to move than you realize.

That’s because, if you already own a home, you’ve likely built-up significant equity, and that can help you fuel your next move. According to the National Association of Realtors (NAR):

“A homeowner who purchased a typical home five years ago would have gained $125,300 from just price appreciation alone.”

In fact, over the last twelve months, CoreLogic reports the average homeowner in the United States gained roughly $64,000 in equity due to home price appreciation.

You can use your equity to help you achieve your homeownership goals. Whether you want to downsize, move closer to loved ones, or buy a home in a dream destination, your equity can help get you there. It may be some (if not all) of what you’d need as your down payment on a home that better fits your changing needs.

To find out how much equity to have in your home, reach out to a trusted real estate professional today.

Bottom Line

Retirement is a big step and so is buying or selling a home. As you move into this new phase of life, let’s connect so you have an expert to guide you through the process as you sell your current home and give you expert advice as you buy one that’ll better suit your needs.

Remember, who you work with matters now more than ever before, call me 310.295.8807!

For all media inquiries, contact: A.LanuzaRE@Gmail.com

#Equity #Downsizing #AgouraHills #Calabasas #Sellers #Buyers #Homes #AnnaLanuzaHomes

Alternatives to central A/C

Cooling your living space doesn’t require an expensive central air conditioning unit. Consider one of these alternatives to get the job done on a budget:

Portable and window air conditioners. Both air conditioner types are an affordable option used to cool a single living space, though portable units are typically more expensive and use more energy. Window units fit directly into your window, while portable units sit on the floor. Their portability and size offer simple installation and relocation from room to room. Both vent warm air out through a window and bring cool air in.

Ductless/mini-split air conditioners. A hybrid of a window and central air conditioner, these units are positioned on a wall or ceiling and use a small condenser that vents air outside — without the ductwork used for central air conditioning. Their versatility allows them to be placed nearly anywhere in your home. Dual-, triple- and quad-zone units may also be used to install units in multiple rooms. Best of all, ductless air conditioning is energy efficient.

When selecting your air conditioner, always keep in mind the type of room(s) you are cooling, the total cubic footage of the room(s), the number of people who typically use the space(s) and the amount of sunlight exposure in the room(s).

You can also consult a heating, ventilation and air conditioning (HVAC) specialist to help you select the perfect unit for your space. Be sure to evaluate energy efficiency ratios and cooling to understand how efficiently and cost-effectively each unit will cool your space(s). Contact me, I will send you a list of qualified vendors to assist your home improvement needs!

Remember, who you work with matters now more than ever before, call me 310.295.8807!

For all media inquiries, contact: A.LanuzaRE@Gmail.com

#BiddingWars #AgouraHills #Calabasas #Sellers #Buyers #Homes #AnnaLanuzaHomes

Homebuyers turn to ARMs in 2022 as FRM rates jump

After skyrocketing in the first half of 2022, the average adjustable rate mortgage (ARM) rate fell back slightly to an average rate of 4.29% in July 2022, up significantly from 2.48% a year earlier. ARM rates have increased as a direct result of the Federal Reserve’s (the Fed’s) action to raise short-term rates to combat high inflation. Similarly, the average 30-year fixed rate mortgage (FRM) rate has jumped from historic lows in 2022, averaging 5.47% in July 2022, up from 2.84% a year earlier.

The average ARM rate is still below the average 30-year FRM rate, making these riskier mortgage products more appealing to homebuyers seeking to regain purchasing power. Therefore, ARM use has received a boost in 2022 — injecting instability into the housing market.

But ARM rates won’t remain below FRMs for much longer in 2022. The reason? ARM rates are directly tied to the Fed’s benchmark rate, which the Fed has signaled it will continue to increase in 2022. Thus, when the Fed raises rates, ARM rates rise an equal amount. In contrast, FRM rates are heavily influenced by the bond market, which tends to accept lower long-term yields during times of economic uncertainty. As the undeclared 2022 recession intensifies in the months ahead, expect the bond market to keep FRM rates from rising faster than ARM rates. Thus, an inversion in rates is likely in the months ahead, which will slash homebuyer appeal of ARMs instantly.

Updated August 11, 2022. Original copy released April 2014.

ARM rates rise from bottom

ARM rates peaked in 2006 at just over 6%. ARM use (the ratio of ARMs to all other residential mortgage loans) at the time was extremely elevated: three out of every four mortgages originated as ARMs, a recipe of disaster for the future housing market.

The rate is tied to a specified index that varies based on market factors. On adjustment, the new ARM rate equals the yield on the index specified in the ARM note plus the lender’s profit margin. Common indices used to periodically adjust the ARM rate include the:

Treasury Securities average yield – one-year constant maturity;

Cost of Funds;

London Inter-Bank Offered Rate (LIBOR);

3-month Treasury bill;

6-month Treasury bill; and

12-month Treasury bill.

ARMs are riskier than FRMs because the rate reset often results in substantially higher payments, and payment shock. This was experienced on a wide scale during the Millennium Boom as payments rose beyond homebuyers’ ability to pay. California’s 2008-2009 foreclosure crisis was driven in large part by these rate resets. The mortgage market is nearly fully recovered from the foreclosure crisis, seven years later in 2016.

Further, new underwriting standards (the qualified mortgage rules) require ARMs to be underwritten at the maximum allowable interest rate after five years from the date of the first payment. These new rules attempt to mitigate the risk of payment shock, which will work if the homebuyer takes out the ARM with the reset rate in mind rather than the more appealing teaser rate. [12 Code of Federal Regulations 1026.43(c)(2)]

So, are ARMs ever beneficial to homebuyers? ARMs do work well for seasoned, short-term investors who plan to sell within the initial lower-rate period. But owner-occupant homebuyers are advised to stay far away.

ARM use follows buyer purchasing power

When FRMs are available to homebuyers at reasonable rates, well-informed home buyers choose FRMs over much riskier ARMs. However, when other market pressures are at work, even well-informed homebuyers find themselves considering the more risky ARM option.

This is because ARM use is tied inescapably to buyer purchasing power. As FRM rates rise, less of the monthly mortgage payment for which a homebuyer qualifies is applied to the principal. Thus, homebuyers cannot afford to buy at the same price they were able to a year earlier. Today’s spread between ARM and 30-year FRM rates is inverted, with ARM rates actually higher than FRM rates.

Likewise, when home prices rise more quickly than the rate of consumer price inflation (CPI) (as they did during the Millennium Boom and more recently during the 2013 year of the speculator), homebuyers are unable to qualify for the same amount of house as they used to.

This is where ARMs come in. Homebuyers turn to ARMs to increase their purchasing power, as the initial interest rate allows more money to be applied to principal. This allows homebuyers to afford a more expensive home. A quick fix, but a poor one in the long run.

Similarly, ARM use declines when FRM rates and prices are low. This occurred in 2009 at the tail end of the recession, when ARM use bottomed at almost zero.

The past year has seen a difference between ARM and FRM average rates too small to sway many homebuyers into considering the risks of taking out an ARM. It won’t be un until FRM rates rise again — not likely to occur until 2022-2023 — that ARM use began to rise.

Prior to 2014, mortgage rates had been on a steady decline since 1980. This downward trend enabled lenders and agents to encourage homebuyers to “just refinance” out of their resetting ARMs. However, the next two to three decades will bring a slow tide of rising mortgage rates. Thus, ARMs have the potential to be more dangerous for homebuyers in years to come than in recent memory.

Remember, who you work with matters now more than ever before, call me 310.295.8807!

For all media inquiries, contact: A.LanuzaRE@Gmail.com

#BiddingWars #AgouraHills #Calabasas #Sellers #Buyers #Homes #AnnaLanuzaHomes

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers competed with one another to be the winning offer.

But what was once your greatest challenge may now be your greatest opportunity. Today, data shows buyer demand is moderating in the wake of higher mortgage rates. Here are a few reasons why this shift in the housing market is good news for your homebuying plans.

The Challenge

There were many reasons for the limited number of homes on the market during the pandemic, including a history of underbuilding new homes since the market crash in 2008. As the graph below shows, housing supply is well below what the market has seen for most of the past 10 years (see graph below):

The Opportunity